Posts

- What’s the real difference when NerdWallet cards “Associate FDIC” versus. “fund covered by FDIC” for the savings membership?

- Flexible Acquisition out of Detachment (NOW) Account

- Simply how much attention do i need to secure to your $ten,000 once a year in the a top-produce checking account?

- Yabby Gambling enterprise $one hundred Totally free Processor chip: Best Bonus to own Gambling establishment Dining table Game

At the same time, internet sites similar to this are very important in terms of in control betting. Which, if you would like a casual experience with online gambling rather than risking much, choose this type of website. So it disclaimer try susceptible to changes without notice, and it is the burden of one’s reader to examine and you may comprehend the disclaimer before relying on every piece of information part of the website article. Mcdougal as well as the system disclaim any responsibility the losses otherwise damage sustained by the people or organizations right down to the information presented within site. I encourage asking an attorney prior to making decisions otherwise taking action according to the suggestions considering in this article.

You’re necessary to deposit a hundred% of the tax liability to the or until the put due date. However, punishment will not be removed deposit below 100% in the event the all of the next criteria is fulfilled. For example, in the event the a deposit https://happy-gambler.com/svea-casino/ must be manufactured on the a tuesday and Monday is actually an appropriate holiday, the brand new put would be felt fast when it is created by next Tuesday (if that Monday is actually a business date). Independent deposit requirements to have companies out of each other ranch and nonfarm pros.

What’s the real difference when NerdWallet cards “Associate FDIC” versus. “fund covered by FDIC” for the savings membership?

- Either way, knowing the words prior to deposit assures you have made an educated feel.

- Zero lender details are required, providing an additional level of privacy.

- While the market for lending products anticipates upcoming manner, the effects from following FOMC speed slices are often mirrored in the cost through to the genuine cuts exist.

- We inquire about everything for the Form 945 to manage the internal Money laws and regulations of the You.

Productive Oct 17th, 2025, Individuals will struggle to manage the fresh enrollments via EFTPS.gov. While you are just one taxpayer and are not signed up for EFTPS.gov by the October seventeenth, you’ll want to create an enthusiastic Internal revenue service On the web Take into account Somebody otherwise use the Irs Direct Pay guest road. Use the Treasury Take a look at Confirmation System to confirm the consider your gotten try genuine and granted by the bodies.

Flexible Acquisition out of Detachment (NOW) Account

Deposit money within forty-five days of opening the newest membership and sustain balance for around 3 months. It’s well worth noting that if organizations provide inventory advertisements, it’s likely the firm advertises the best prospective award, but the reality is there is an extremely quick possibility you’ll be able to actually have that matter. The new agent venture that really needs a decreased deposit count try of TradeStation, which offers a $fifty dollars award to the a deposit out of $five-hundred or even more.

Simply how much attention do i need to secure to your $ten,000 once a year in the a top-produce checking account?

A great Medicare Virtue MSA is a keen Archer MSA appointed by the Medicare for usage entirely to pay the newest certified medical expenses of the newest account proprietor who is entitled to Medicare. In order to meet the fresh comparability conditions to have eligible staff that have none founded a keen HSA by the December 29 nor informed your which they has a keen HSA, you should see a notification requirements and a contribution demands. If you need your staff to be able to has HSAs, they need to have an enthusiastic HDHP. For individuals who withdraw those numbers, the amount try handled exactly like all other distribution out of a keen HSA, talked about later.. Declaration all the efforts to your HSA to the Form 8889 and you will file they with your Function 1040, 1040-SR, or 1040-NR.

In this article, I’meters gonna show an informed financial offers I understand regarding the, one another checking account now offers and family savings also provides and you will added bonus signal right up now offers worth considering. We start by across the country bonuses but also are several large dollar bonuses of banks that have an inferior geographic impact. HRAs try financed only due to boss contributions and could not funded thanks to employee paycheck decreases under a good cafeteria package.

These integrated brick-and-mortar banking companies, borrowing from the bank unions, on line banking institutions and you may economic technical organizations. You might like to manage to be eligible for one or more incentive in the exact same financial, but it utilizes the bank’s regulations. Often, a financial enable people to profit out of numerous also provides, as long as they’lso are for several membership brands. Such, you happen to be capable score a bank checking account extra and a checking account incentive, however a couple of bank account incentives. This really is a mixed examining and you will checking account, you could play with one or both depending on the means, without paying people charges.

- Not merely performs this casino accept lowest dumps, but inaddition it makes use of powerful security measures to safeguard your details and you can transactions, making sure safe and you will enjoyable betting.

- Organization checking offers am more difficult to sign up to have than just personal examining incentives.

- To have earnings paid to help you a-work webpages personnel, a CPEO is eligible on the borrowing if the CPEO otherwise a consumer of one’s CPEO made the brand new contribution with regards to a work web site personnel.

- Setting 8974 is utilized to search for the amount of the financing that can be used in the current one-fourth.

- You’ll need to pay a fee every month to possess Balanced Examining otherwise Options Checking, as well as the criteria so you can waive those fees is generally difficult to see for most users.

- If you are desire or punishment together with your commission, select and you can go into the amount at the end margin out of Function 1042.

You will still owe an entire boss display from public security and you can Medicare taxation. The brand new staff stays accountable for the fresh personnel share of social defense and Medicare fees. And see the Recommendations for Form 941-X, the brand new Tips to possess Setting 943-X, or even the Guidelines to possess Mode 944-X. See Cashback Debit is an online savings account away from Come across (which you probably know for the of a lot credit cards).

If you deposited over a correct number to your 12 months, you can have the newest overpayment reimbursed (over lines 6c–6e to own head put) or placed on your following return by the checking the right field. For many who wear’t consider sometimes package or if you look at one another packages, generally we are going to implement the newest overpayment to the 2nd return. No matter what people field you look at or wear’t review range 6b, we could possibly use your own overpayment to virtually any delinquent income tax membership which is shown within our info under your EIN. Less than an installment contract, you could potentially spend what you owe within the monthly obligations.

If you aren’t permitted sign up centered on family, business or area, you can are a member from the signing up for certainly one of DCU’s performing teams. We like that membership have a relatively lower minimum deposit specifications, that it’s useful for both the brand new and you can dependent savers. Synchrony Lender Certificates from Put’s prolonged-name Cds are a good selection for savers who want to avoid lowest balance requirements and they are comfy securing their money away for quite some time in return for a competitive APY.

If you have a Chase bank account, you could potentially speak to a great banker to help you upgrade the brand new account. The greatest added bonus for the our very own number boasts one of many steepest deposit criteria. But, for those who have tall fund so you can put and so are looking concierge provider, Chase Personal Consumer Examining was an excellent option. One which just discover a new checking account, make sure you’re perhaps not making money on the new dining table by the lost an advertising offer. Gambling enterprises provide no deposit bonuses while the an advertising equipment to attract the brand new people, giving them a preferences out of just what gambling enterprise offers hoping they will still play despite the main benefit is put.

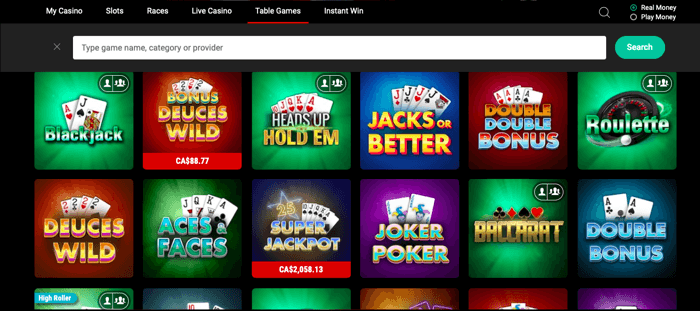

Yabby Gambling enterprise $one hundred Totally free Processor chip: Best Bonus to own Gambling establishment Dining table Game

Code part 7654 and you will forty-eight You.S.C. section 1421(h) render your U.S. Authorities is needed to shelter out over the new Treasury of Guam the brand new federal taxes withheld on the numbers paid in order to army and you may civil staff and you will pensioners that are owners out of Guam. The outcome of those provisions is that the government transmits for the at the very least an annual foundation the fresh government income taxes withheld or accumulated from the staff and you may pensioners who are owners of Guam to your Guam Treasury. Code sections 931(a), 931(d), and you can 7654 provide your You.S. Bodies is needed to transfer (“defense more”) to the Treasury out of American Samoa the brand new federal income taxes withheld on the amounts repaid in order to armed forces and civilian group and you may pensioners who try owners away from Western Samoa. A manager will get outsource certain or each of its federal work tax withholding, revealing, and you may payment loans.